Inside This Issue

NEWSfeed

- U.S. Takes Canada To Task

- New Sawmill Comes To Life

THE ISSUES: The Gift That Keeps On Giving

“Alot of people would like to do something about Canadian imports. Do we think we could draw a coalition of large businesses and small businesses nationwide?”

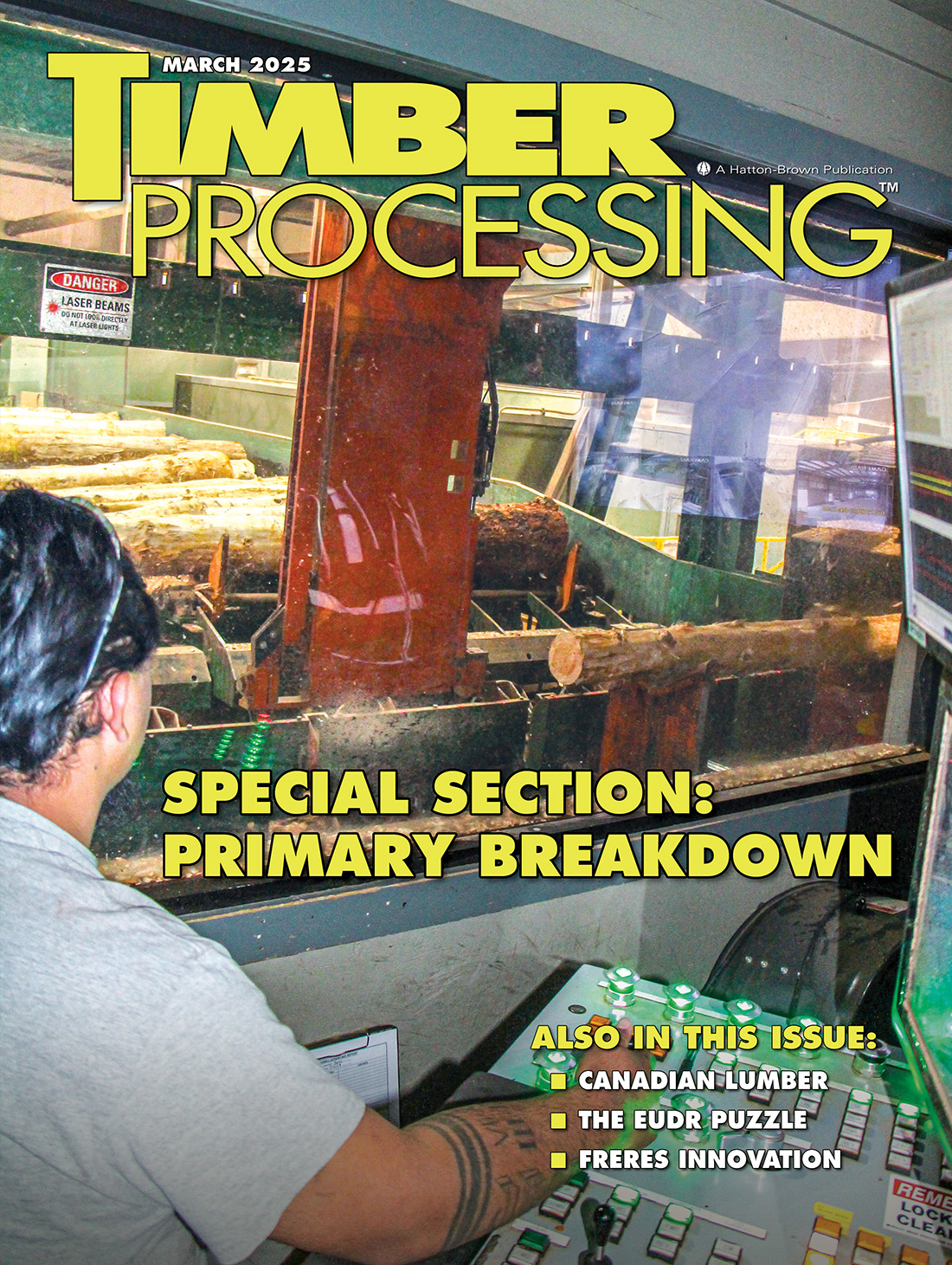

COVER: Special Section: Primary Breakdown

EDITOR’S NOTE: The following companies submitted these editorial profiles and images to complement their advertisements placed elsewhere in this issue. Please refer to those advertisements for web site and contact information. All statements and claims are at- tributable to the companies.

- ANDRITZ

- CARBOTECH

- CLEEREMAN INDUSTRIES

- COMACT

- CONE OMEGA

- HURDLE MACHINE WORKS

- LINCK

- MCDONOUGH MANUFACTURING

- MEBOR

- MELLOTT MANUFACTURING

- REAL PERFORMANCE MACHINERY

- TS MANUFACTURING

- USNR

- WOOD-MIZER

MACHINERY Row

- Con-Vey Announces Expansion, Promotion

- Luvian Saha Adds Drying Capacity

- Timberlab Collaborates With SCM on CLT

- Port Of Savannah Welcomes Largest Vessel

- Freres EW Installs Horizontal Grinder

AT Large

- Southeastern Timber Will Enlarge Ackerman

- Interfor Sizes Up Lumber Markerts

Find Us On Social

The Issues: The Gift That Keeps On Giving

Article by Rich Donnell, Editor-in-Chief, Timber Processing

“Alot of people would like to do something about Canadian imports. Do we think we could draw a coalition of large businesses and small businesses nationwide?”

That question was asked a mere 41 years ago, in 1984, by Charles Thomas of

Mississippi’s Shuqualak Lumber, during a meeting of the Southeastern Lumber Manufacturers Assn. at the Grand Hotel in Point Clear, Ala.

Each time the U.S.-Canada softwood lumber imports dispute rears up, I always think back to that meeting, which I attended—one of my first assignments not long after joining Hatton-Brown Publishers, Inc.

Not that I knew much about the issue, or the lumber industry for that matter, but I remember buying in to what Mister Thomas and several other lumbermen had to say—that Canadian softwood lumber companies received a government subsidy in the form of non-competitive, below-market harvesting fees on publicly owned lands, allowing those operations to export and sell their lumber in the U.S. with an unfair advantage. Canadian interests countered that timber accessibility and required forest management services on the part of the companies were important cost factors.

The reason for that meeting was because the previous year the U.S. Dept. of Commerce had ruled against a petition filed by the U.S. lumber industry to impose a countervailing duty on imported softwood lumber from Canada. It had been a loosely organized effort on the part of the U.S. lumber industry, so now they were meeting in Point Clear to become more organized. Which they did, indeed forming a coalition, as Charles Thomas had proposed, and filing another petition, which this time the DOC ruled in favor of in 1986, resulting in a lumber duty of 15%.

It has been a battle ever since—petitions and appeals, domestic and international panel rulings, with some agreements mixed in, such as the five-year agreement in 1996 which put a cap on the amount of softwood lumber that Canada could export annually to the U.S.; and a 10-year agreement that started in 2006 in which the duty was not triggered until lumber prices dropped to a certain range.

Since that agreement ended, it has been more back and forth, with most recently in 2024 the U.S. DOC determining an anti-subsidy and dumping duty of 14.54%—not far different than that 15% of four decades ago.

The most recent “rearing up,” as reported elsewhere in this issue, came from the U.S. Lumber Coalition, mainly in response to U.S. homebuilder claims that duties on Canadian softwood lumber serve to drive up the cost of new homes for consumers. It’s an old argument, which in fact a representative of the National Assn. of Home Builders had stated during that 1984 meeting.

The U.S. Lumber Coalition offered statistics that it says proves otherwise, and meanwhile, for the first time that I can remember, said the U.S. doesn’t need Canadian lumber anyway; that growing U.S. lumber production capacity can meet the requirements of the U.S. homebuilding market; that maybe Canada should look elsewhere to export their lumber.

An interesting twist to this entire tale is that many of the independent U.S. lumbermen in the room in 1984 ultimately sold their mills to Canadian corporations, which now heavily dot the U.S. softwood lumber mill landscape, and thus compete with their own imported lumber, duty be damned.

Want More Content?

Timber Processing magazine is delivered 11 times per year to subscribers, who represent sawmill ownership, management and supervisory personnel and corporate executives.

Newsletter

The monthly Timber Processing Industry Newsletter reaches over 4,000 mill owners and supervisors.

Subscribe/Renew

Timber Processing is delivered 10 times per year to subscribers who represent sawmill ownership, management and supervisory personnel and corporate executives. Subscriptions are FREE to qualified individuals.

Advertise

Complete the online form so we can direct you to the appropriate Sales Representative.