Inside This Issue

NEWSfeed

- USFS Seeks 25% More Timber Sales

- SPI Names Emmerson VP of Lumber Operations

- TimberHP Expects Long-Term Success

- Walmart Inatalls Mercer CLT, Glulam

- Sumitomo Buys Teal Jones Mill

THE ISSUES: Is The Logging Industry Teetering?

Next month, you will read the results of our annual U.S. Sawmill Operations & Capital Expenditure Survey. It should be quite interesting, with several questions in the survey devoted to President Trump’s tariffs policy and the administration’s executive order for greater production of wood products and more timber sales on national forests.

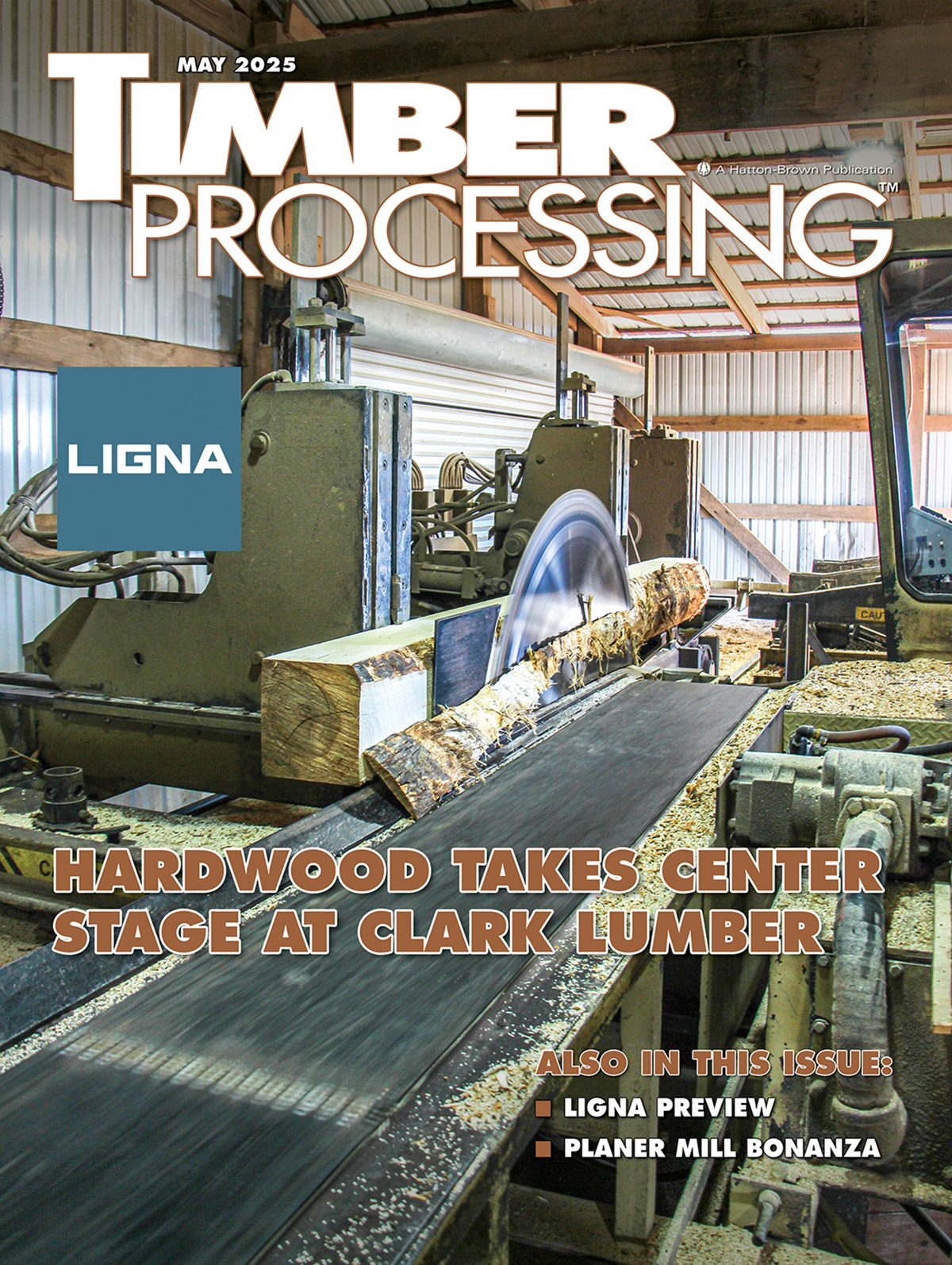

COVER: Chasing Demand

Father-son duo blends grit and experience to weather market shifts, embrace innovation.

RED BOILING SPRINGS, Tenn. Beef cattle formerly grazed these 50 scenic acres west of the Cumberland Plateau before the Clark family established its sawmill footprint in the heartland of central Tennessee in 1982. Cultivating green pastures into green lumber, Clark Lumber Co. solidified itself as a reliable producer of the region’s diverse supply of hardwood species and has exported high-grade, American-made forest products across the world.

Article by Patrick Dunning, Associate Editor, Timber Processing

PLANER Mill BONANZA

- Carbotech

- Comact

- Gilbert

- Kallfass

- Ledinek Engineering

- Limab

- Piche

- Samuel

- Springer

- TS Manufacturing

- USNR

- Wolftek

- Yates-American

MACHINERY Row

- KDS Windsor Reports 100th CDK Order

- Timberlab Calls On Italy’s SCM

- Charles Ingram Installs 170-Footer

AT Large

- Barbee Put 50 Years In Industry

Find Us On Social

The Issues: Is The Logging Industry Teetering?

Article by Rich Donnell, Editor-in-Chief, Timber Processing

Next month, you will read the results of our annual U.S. Sawmill Operations & Capital Expenditure Survey. It should be quite interesting, with several questions in the survey devoted to President Trump’s tariffs policy and the administration’s executive order for greater production of wood products and more timber sales on national forests.

Meanwhile, in this the season of surveys, our sister publication, Timber Harvesting, is currently collecting the answers from its latest annual Logger Survey, the results of which will appear in the July/August issue of Timber Harvesting. Logger responses from around the country were beginning to come in as I considered what to write about in this space, and I couldn’t help but to take a peek at the early wave of input from loggers.

It’s not a pretty picture.

We speak frequently about sustainability in forest management and wood products, but the question that comes to mind: Is the logging industry itself a sustainable industry? I’m referring to the logging industry that’s composed of independent operators, usually one to two crews, a million to three million dollars of investment.

- The reason I ask, based on the early returns from the logger survey: l 67% of the owners are more than 50 years old.

- 47% have recently downsized their operations.

- 30% lost money in the past year.

- 70% said their financial health was less than good.

- 47% of the owners took a paycut in the past year.

- 25% said they were likely to get out of business in the next five years and another

- 45% said they certainly weren’t expanding.

- 90% were negative on being able to find new employees to replace existing ones who leave or retire.

- About as many said their industry exit plan was looking at an auction selloff (33%) as said they would transfer the business to a family member (35%).

The story in the July/August issue of Timber Harvesting will go into greater detail on what loggers are saying about why these conditions exist—expenses, markets, rates, etc.

But the simple snapshot I’ve provided here is cause for consideration. For example, we’ve heard more in recent years about wood products companies running their own company logging operations. If this is a trend, many of these independent logging business owners may find themselves as a foreman for a wood products producer in five years, if they haven’t already. This would be a significant development, though not a new one, historically, given that the history of company logging crews is as old as the hills, as they say.

But it may at the moment fall short of being a “trend.” We’ve also heard of wood products producers who got into company logging in recent years, selling back out of it.

Company logging or not, the question for wood products markets and producers is what is their responsibility in how the logging industry shakes out, and how can they contribute to a healthier logging industry?

Want More Content?

Timber Processing magazine is delivered 11 times per year to subscribers, who represent sawmill ownership, management and supervisory personnel and corporate executives.

Newsletter

The monthly Timber Processing Industry Newsletter reaches over 4,000 mill owners and supervisors.

Subscribe/Renew

Timber Processing is delivered 10 times per year to subscribers who represent sawmill ownership, management and supervisory personnel and corporate executives. Subscriptions are FREE to qualified individuals.

Advertise

Complete the online form so we can direct you to the appropriate Sales Representative.